Daily Review for June 09, 2022

Traders are watching the European Central Bank’s interest rate decision today. Analysts expect that the ECB will not raise rates today, but only at the July 2022 meeting.

The WTI price continues close to resistance 3, maintaining the uptrend. As a result, the price of gasoline in the US is at its highest average in recent times, reaching USD$5 per gallon.

Bitcoin remains sideways above the USD$30,000 area. At the moment Tesla and other companies have returned to buy Bitcoin, reaching a purchase volume of USD$300 million.

Natural gas prices are currently correcting 5.36% due to a fire at an LNG plant in Texas, USA, which is causing delays in exports of the commodity in the country.

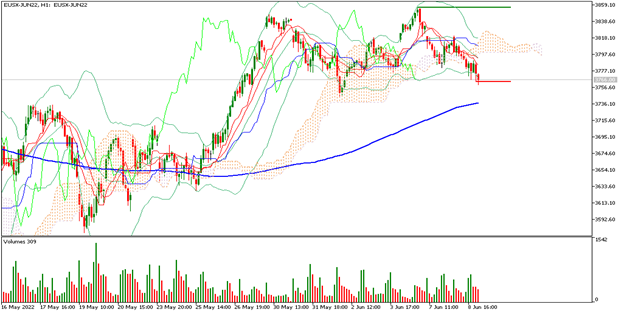

| EUROSTOXX 50 -0.24% |

| Traders are looking ahead to the European Central Bank’s interest rate decision today. Analysts expect that the ECB will not raise rates today, but only at the July 2022 meeting. However, the focus is on the press conference of the Bank’s President, Christine Lagarde, on its analysis of the economy and on the monetary policy strategy. It is worth noting that the bank’s strategy for the time being has been to support market growth. The Eurostoxx 50 is currently down 0.24% and is trading at 3,744 points. |

|

| Support 1: 3.737 Support 2: 3.732 Support 3: 3.725 Resistance 1: 3.749 Resistance 2: 3.756 Resistance 3: 3.761 Pivot Point: 3.744 |

| Price is above the 200-day moving average, between support 1 and resistance 1. Expected trading range between 3,725 and 3,761. Pivot point for trend change at 3,744. RSI neutral, so the index could break support 1 and look for the next support level. |

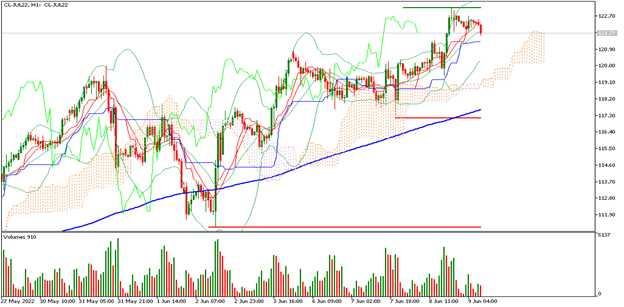

| WTI -0.27% |

| The WTI price continues close to resistance 3, maintaining the upward trend. As a result, the price of gasoline in the US is at its highest average in recent times, reaching USD$5 per gallon. The shares of O&G companies continue to rise. Exxon, for example, has surpassed USD$100 per share. The war in Ukraine has forced BP to shut down a pipeline in the country. An explosion at an LNG terminal in Freeport Texas, USA, has generated a supply shock on natural gas exports from the United States. |

|

| Support 1: 122.10 Support 2: 121.95 Support 3: 121.74 Resistance 1: 122.46 Resistance 2: 122.67 Resistance 3: 122.82 Pivot Point: 122.31 |

| The price is above the 200-day moving average, between resistance 3 and support 1. Expected trading range between USD$121.74 and USD$122.82. Pivot point for trend change at USD$122.31. RSI neutral, so the price could correct some additional points. |

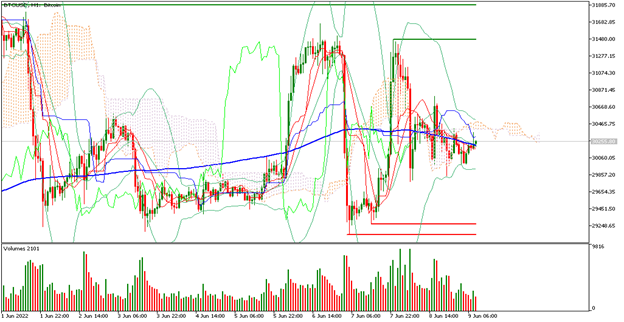

| BITCOIN -0.59% |

| Bitcoin remains sideways above the USD$30,000 area. At the moment Tesla and other companies have returned to buy Bitcoin, reaching a purchase volume of USD$300 million. Microstrategy CEO Michael Saylor, maintains his thesis that Bitcoin could surpass its historical highs in the short term. For the time being, the Bulls and Bears continue to struggle to dominate the short-term trend. Bitcoin has remained sideways during June. |

|

| Support 1: 30,327.5 Support 2: 30,293.8 Support 3: 30,269.7 Resistance 1: 30,385.4 Resistance 2: 30,409.6 Resistance 3: 30.443,3 Pivot Point: 30,351.7 |

| Price is slightly above the 200-day moving average between support 1 and resistance 1. Expected trading range between USD$30,269 and USD$30,443. Pivot point for trend change at USD$30,351. Neutral RSI, which means bears could take the price to USD$29,235, and USD$29,147. |

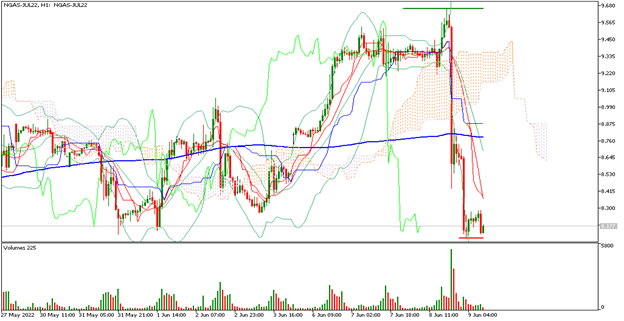

| NATURAL GAS -5.36% |

| Natural gas prices are currently correcting 5.36% due to a fire at an LNG plant in Texas, USA, which is causing delays in exports of the commodity in the country. Natural gas is currently trading at USD$8.20 per BTU. Futures for delivery in the coming months are also in negative territory for the moment, however, traders expect a change of trend in the market soon, due to the supply shock that could be generated in the short term. |

|

| Support 1: 8,078 Support 2: 8.023 Support 3: 7.918 Resistance 1: 8.238 Resistance 2: 8.343 Resistance 3: 8,398 Pivot Point: 8,183 |

| Price is below the 200-day moving average, between support 2 and resistance 3. Expected trading range between USD$7.91 and USD$8.39. Pivot point for trend change at USD$8.18. RSI in oversold zone, which indicates that the price could bounce at any time. |

| Sources |

| Reuters Market watch Bloomberg Capitalix Market Research |

Penafian Risiko

Sebarang maklumat/artikel/bahan/kandungan yang disediakan oleh Capitalix atau yang dipaparkan di laman webnya hanya bertujuan untuk digunakan bagi tujuan pendidikan dan tidak membentuk nasihat pelaburan atau perundingan tentang cara pelanggan harus berdagang.

Walaupun Capitalix telah memastikan bahawa kandungan maklumat tersebut adalah tepat, ia tidak bertanggungjawab terhadap sebarang peninggalan/kesilapan/salah pengiraan dan tidak dapat menjamin ketepatan sebarang bahan atau sebarang maklumat yang terkandung di sini.

Oleh itu, sebarang pergantungan yang anda letakkan pada bahan tersebut adalah atas risiko anda sendiri. Sila ambil perhatian bahawa tanggungjawab untuk menggunakan atau bergantung pada bahan tersebut terletak sepenuhnya kepada pelanggan dan Capitalix tidak menerima liabiliti untuk sebarang kerugian atau kerosakan, termasuk tanpa had, sebarang kehilangan keuntungan yang mungkin timbul secara langsung atau tidak langsung daripada penggunaan atau pergantungan pada maklumat tersebut.

Amaran Risiko: Perdagangan Forex/CFD melibatkan risiko yang ketara terhadap modal yang dilaburkan. Sila baca dan pastikan bahawa anda memahami sepenuhnya kandungan Dasar Pendedahan Risiko.

Anda harus memastikan bahawa, bergantung pada negara tempat tinggal anda, anda dibenarkan untuk berdagang produk Capitalix.com. Sila pastikan bahawa anda sudah betul-betul faham dengan pendedahan risiko syarikat.