Daily Review for July 1, 2022

The first two quarters of the year ended with the worst losses on Wall Street since 1970. The Dow Jones is currently down 0.32% and is trading at 30,913 points.

UK gross domestic product grew 8.7% for Q1 2022 compared to Q1 2022 on a yearly basis. Inflation in France for May 2022 came in at 0.7%. Germany’s unemployment rate increased to 5.3% for the month of June.

The IEA announced last week that natural gas reserves increased by 74 billion cubic feet versus analysts’ expectations of 60 billion.

Ethereum and Bitcoin are at a key support level, which could signal either a rebound towards USD$1,300 and USD$25,000 respectively, or a decline towards the lowest levels in years.

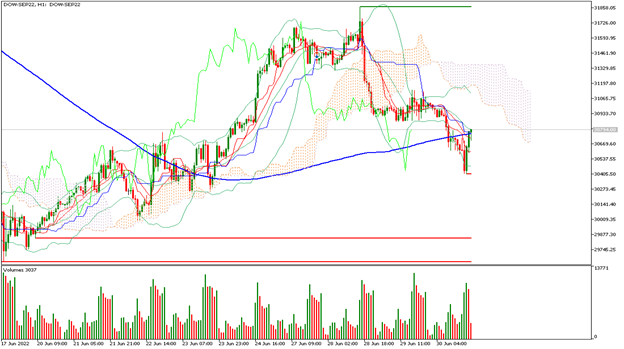

| DOW JONES -0.32% |

| The first two quarters of the year ended with the worst losses on Wall Street since 1970. The Dow Jones is currently down 0.32% and is trading at 30,913 points. World stock markets are in a bear market. Central banks have started a restrictive monetary policy and investors’ fear of a global economic recession has generated panic. High inflation and supply and demand imbalances could hit household consumption, which is one of the most important demand variables for global economic growth. |

|

| Support 1: 30679.0 Support 2: 30558.5 Support 3: 30495.4 Resistance 1: 30862.6 Resistance 2: 30925.7 Resistance 3: 31046.2 Pivot Point: 30742.1 |

| Despite the fall, the price is above the 200-day moving average, between resistance 2 and support 2. Expected trading range between 30,495 and 31,046. Pivot point for trend change at 30,742. Neutral RSI, which could generate buying interest from institutional investors at the current level, anticipating a rebound in the price of stock indexes. |

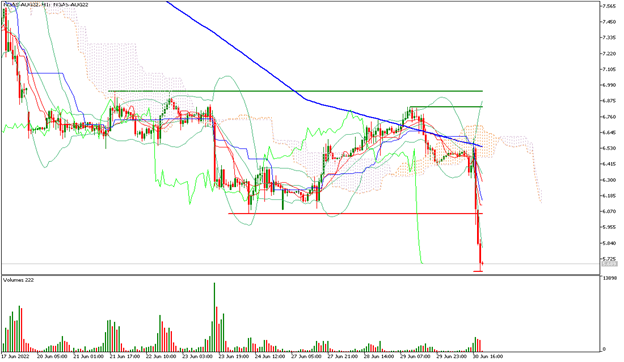

| EUROSTOXX 50 -1.23% |

| UK gross domestic product grew by 8.7% for Q1 2022 compared to Q1 2022 on a yearly basis. Inflation in France for May 2022 stood at 0.7%. Germany’s unemployment rate increased to 5.3% for the month of June. Traders are looking forward to statements from European Central Bank President Christine Lagarde, who may give signals on the bank’s interest rate hike, which is expected in July 2022. |

|

| Support 1: 3,432 Support 2: 3,411 Support 3: 3,400 Resistance 1: 3,464 Resistance 2: 3,475 Resistance 3: 3,496 Pivot Point: 3,443 |

| Price is below the 200-day moving average, between resistance 2 and support 1. Expected trading range between 3,400 and 3,496. Pivot point for trend change at 3,443. RSI neutral, so the market could continue sideways or bearish, while traders know the Eurozone inflation results tomorrow. |

| NATURAL GAS -12.62% |

| The IEA announced last week that natural gas reserves increased by 74 billion cubic feet versus analysts’ expectations of 60 billion cubic feet. Traders are watching today’s report. During June, the price of gas has lost more than 20%. High inventories at the Freeport plant have also caused prices to fall, due to the high level of supply in the market. At this moment the price of gas is falling 12.62% and is trading at USD$5.64 per BTU. |

|

| Support 1: 5.599 Support 2: 5.504 Support 3: 5.370 Resistance 1: 5.828 Resistance 2: 5.962 Resistance 3: 6.057 Pivot Point: 5.733 |

| Price is below the 200-day moving average, between resistance 1 and support 4. Expected trading range between USD$5.37 and USD$6.05. Pivot point for trend change at USD$5.73. RSI in oversold zone, so it could be attractive for the Bulls in the market. |

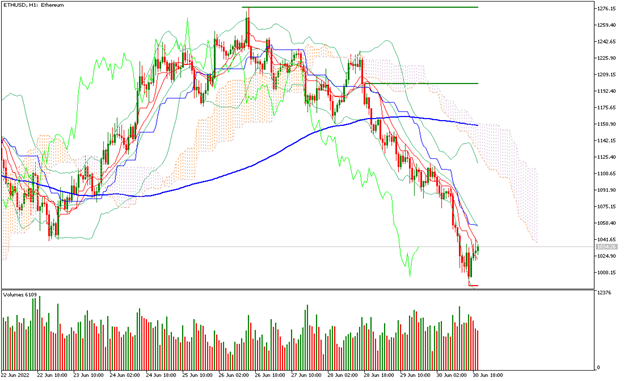

| ETHEREUM -5.92% |

| Ethereum and Bitcoin are at a key support level, which could signal either a rebound towards USD$1,300 and USD$25,000 respectively, or a decline towards the lowest levels in years. Investors are looking forward to Ethereum’s upgrade to 2.0. And also to the Crypto Tour that will be held next week in Barcelona, where they will analyze the prospects of the industry after the crypto winter. |

|

| Support 1: 1,024.79 Support 2: 1,015.48 Support 3: 1,005.21 Resistance 1: 1,044.37 Resistance 2: 1,054.64 Resistance 3: 1,063.95 Pivot Point: 1,035.06 |

| The price is below the 200-day moving average, between resistance 1 and support 2. Expected trading range between USD$1,005 and USD$1,063. RSI in oversold zone, so traders could evaluate a further fall or take bullish positions waiting for a rebound. |

| Sources |

| Reuters Market watch Bloomberg Capitalix Market Research |

Penafian Risiko

Sebarang maklumat/artikel/bahan/kandungan yang disediakan oleh Capitalix atau yang dipaparkan di laman webnya hanya bertujuan untuk digunakan bagi tujuan pendidikan dan tidak membentuk nasihat pelaburan atau perundingan tentang cara pelanggan harus berdagang.

Walaupun Capitalix telah memastikan bahawa kandungan maklumat tersebut adalah tepat, ia tidak bertanggungjawab terhadap sebarang peninggalan/kesilapan/salah pengiraan dan tidak dapat menjamin ketepatan sebarang bahan atau sebarang maklumat yang terkandung di sini.

Oleh itu, sebarang pergantungan yang anda letakkan pada bahan tersebut adalah atas risiko anda sendiri. Sila ambil perhatian bahawa tanggungjawab untuk menggunakan atau bergantung pada bahan tersebut terletak sepenuhnya kepada pelanggan dan Capitalix tidak menerima liabiliti untuk sebarang kerugian atau kerosakan, termasuk tanpa had, sebarang kehilangan keuntungan yang mungkin timbul secara langsung atau tidak langsung daripada penggunaan atau pergantungan pada maklumat tersebut.

Amaran Risiko: Perdagangan Forex/CFD melibatkan risiko yang ketara terhadap modal yang dilaburkan. Sila baca dan pastikan bahawa anda memahami sepenuhnya kandungan Dasar Pendedahan Risiko.

Anda harus memastikan bahawa, bergantung pada negara tempat tinggal anda, anda dibenarkan untuk berdagang produk Capitalix.com. Sila pastikan bahawa anda sudah betul-betul faham dengan pendedahan risiko syarikat.