Daily Review for June 29, 2022

Wall Street posted a significant drop today due to increasing household fears about rising prices in the economy.

The Bitcoin market continues to move sideways in a downtrend. Traders had assessed a possible rebound. However, fears of an impending recession have triggered another sell-off.

The gold price is correcting 0.05% at the moment and is trading at USD$1,819 per Troy ounce. However, it could present an upward movement due to the sales that are being generated in equities.

Russia announced that it could generate a total impact on the European energy market in a scenario of an attack on the Port of Rotterdam. For its part, according to the IEA, gas consumption in Europe should decrease by 1/3.

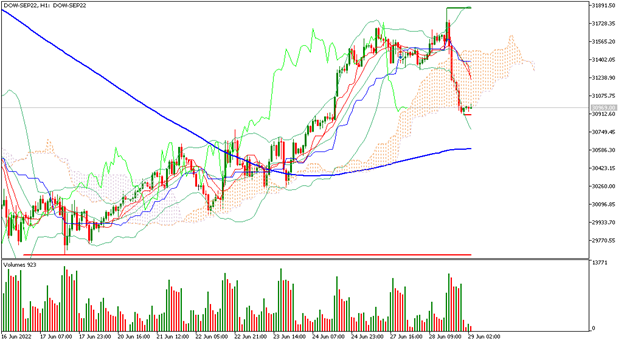

| DOW JONES +0.15% |

| Wall Street posted a significant decline today due to increased household fears about rising asset prices in the economy. The consumer report did not meet market expectations. Rising prices due to high inflation globally have caused households to tighten their spending. Analysts see an imminent recession also due to the high level of access to capital that companies and investors will have due to the increase in interest rates. The Dow Jones closed today with a drop of 1.56%, equivalent to 491 points. |

|

| Support 1: 30954.0 Support 2: 30927.0 Support 3: 30904.0 Resistance 1: 31004.0 Resistance 2: 31027.0 Resistance 3: 31054.0 Pivot Point: 30977.0 |

| Despite the fall, the price is above the 200-day moving average, between resistance 2 and support 3. Expected trading range between 30,904 and 31,054. Pivot point for trend change at 30,977. RSI in oversold zone, which may generate a market rebound. |

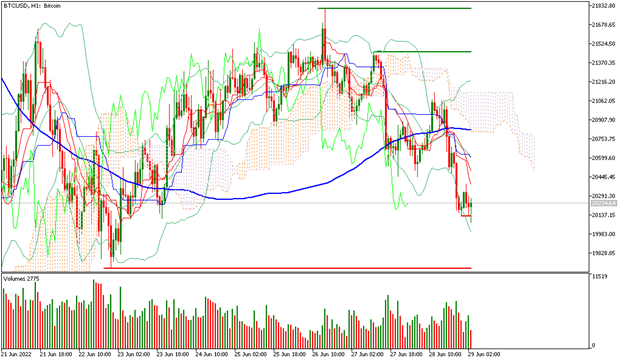

| BITCOIN -2.21% |

| The market continues sideways with a bearish trend. Traders had assessed a possible rebound. However, the fear of an impending recession has triggered another sell-off. The bears are still looking for USD$10,000 or even USD$8,000. Miners continue to sell part of their Bitcoins. Institutions and small investors likewise. However, the Holders maintain their positions as well as the big investment funds in Cryptos. |

|

| Support 1: 20,196.1 Support 2: 20,125.2 Support 3: 20,046.3 Resistance 1: 20,345.8 Resistance 2: 20,424.6 Resistance 3: 20,495.5 Pivot Point: 20,274.9 |

| The price is below the 200-day moving average, which is a bearish signal for Bitcoin. Expected trading range between USD$20,046 and USD$20,495. Pivot point for trend change at USD$20,274. RSI neutral, but close to the oversold zone, which could generate buying interest. However, traders are waiting for a drop below USD$20,000 to enter. |

| GOLD -0.05% |

| The gold price is correcting 0.05% at the moment and is trading at USD$1,819 per Troy ounce. However, it could present an upward movement due to the sales that are being generated in equities and the interest of investors in holding metals, Euros, USD, and fixed income. The eventual recession will generate less cash flow for companies and households, so the stock market could remain sideways. Hedge funds see buying opportunities at a discount, expecting an interesting rebound when the inflation level falls to the 2% annual target. |

|

| Support 1: 1819.10 Support 2: 1818.65 Support 3: 1817.75 Resistance 1: 1820.45 Resistance 2: 1821.35 Resistance 3: 1821.80 Pivot Point: 1820.00 |

| Price is below the 200-day moving average, between support 2 and resistance 1. Expected trading range between USD$1,817 and USD$1,821. Pivot point for trend change at USD$1,820. RSI neutral, but remains near the oversold zone. Possible start of buying in this zone. |

| NATURAL GAS +0.30% |

| Russia announced that it could generate a total impact on the European energy market in a scenario of an attack on the Port of Rotterdam. For its part, according to the IEA, gas consumption in Europe should decrease by 1/3. China, on the other hand, has increased its imports of oil, coal and natural gas produced in Russia. The United States continues the flow of LNG exports to Europe. Natural gas is currently up 0.30% and is trading at USD$6.62 per BTU. |

|

| Support 1: 6,665 Support 2: 6.653 Support 3: 6,643 Resistance 1: 6.687 Resistance 2: 6.697 Resistance 3: 6.709 Pivot Point: 6.675 |

| Price is slightly below the 200-day moving average, between resistance 1 and support 1. Expected trading range between USD$6.65 and USD$6.70. Pivot point for trend change at USD$6.67. RSI coming out of the overbought zone, so the price could remain sideways above this zone before correcting and setting a new trend. |

| Sources |

| Reuters Market watch Bloomberg Capitalix Market Research |

Divulgation des risques

Toute information/article/matériel/contenu fourni par Capitalix ou affiché sur leur site web est destiné à être utilisé à des fins éducatives uniquement et ne constitue pas un conseil d’investissement ou une consultation sur la façon dont le client devrait faire du trading.

Bien que Capitalix ait veillé à l’exactitude du contenu de ces informations, elle n’est pas responsable de toute omission/erreur/malentendu et ne peut garantir l’exactitude de tout matériel ou de toute information contenue dans ce document.

Par conséquent, toute confiance que vous accordez à ce matériel est strictement à vos propres risques. Veuillez noter que la responsabilité de l’utilisation ou de la fiabilité de ce matériel incombe au client et que Capitalix n’accepte aucune responsabilité pour toute perte ou tout dommage, y compris, sans s’y limiter, toute perte de profit pouvant découler directement ou indirectement de l’utilisation ou de la fiabilité de ces informations.

Avertissement de risque: Le trading de Forex/CFDs implique un risque conséquent pour votre capital. Veuillez lire et vous assurer que vous comprenez parfaitement notre Politique de claude de non-responsabilité.

Vous devez vous assurer que, selon votre pays de résidence, vous êtes autorisé à trader les produits de Capitalix.com. Veuillez vous assurer que vous êtes familier avec la divulgation des risques de l’entreprise.