Daily Review for June 24, 2022

It appears that the Bitcoin price drop to USD$17,000 was caused by the USD$500 million sale of the Purpose Bitcoin ETF.

Wall Street closed higher, however, global markets remain mixed on fears of a global economic recession. Stock index futures are starting to correct.

One of the world’s largest commodity traders, Russian-based Gunvor, may supply 13 million gallons of gasoline to the United States.

Traders are looking forward to the European leaders’ summit. One of the main topics is Ukraine’s accession to the European Union.

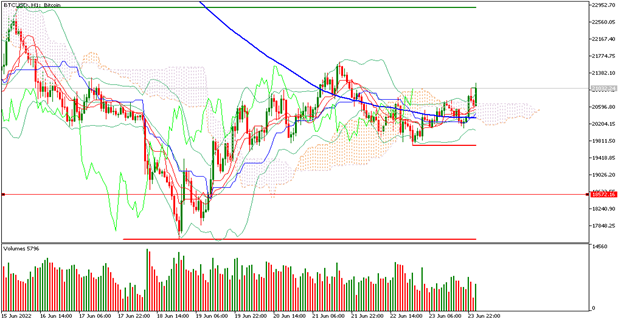

| BITCOIN +5.44% |

| It seems that the fall of the Bitcoin price to USD$17,000 was caused by the sale of USD$500 million of the Purpose Bitcoin ETF. According to the ETF’s management, the sales movements have been made anonymously, so there is no way of knowing who caused the drop. What possibly triggered the selling was the need to cover debt collateral. Possibly the over-leveraged funds. According to Deribit data, option contracts for more than USD$2 billion in BTC expire today. In this regard, bears are again looking for USD$17,500 support, while Bulls are looking to buy at a discount hoping for a major rebound. |

|

| Support 1: 20,687.6 Support 2: 20,420.3 Support 3: 20,192.6 Resistance 1: 21,182.6 Resistance 2: 21,410.3 Resistance 3: 21.677,6 Pivot Point: 20,915.3 |

| The price is above the 200-day moving average, which is a bullish sign. Price is between support 1 and resistance 1. Expected trading range between USD$20,192 and USD$21,677. Pivot point for trend change at USD$20,915. RSI approaching the overbought zone. Traders are watching for options liquidation. In the meantime, some initial profit taking may occur. |

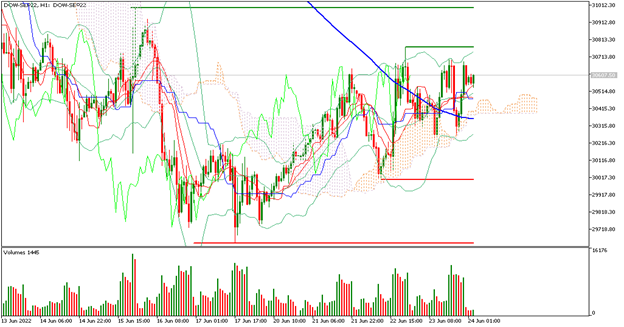

| DOW JONES INDUSTRIAL AVERAGE -0.10% |

| Wall Street closed higher, however, global markets remain mixed due to fears of a global economic recession. Stock index futures are starting to correct. The Dow Jones is currently down 0.10% and is trading at 30,637 points. The FED announced that US banks have good levels of liquidity that will allow them to withstand a recession. Economists continue to evaluate the level of domestic demand in the U.S., which is a key variable in assessing the impact of the recession. |

|

| Support 1: 30559.3 Support 2: 30536.3 Support 3: 30497.8 Resistance 1: 30620.8 Resistance 2: 30659.3 Resistance 3: 30682.3 Pivot Point: 30597.8 |

| Price is above the 200-day moving average, between resistance 1 and support 1. Expected trading range between 30,497 and 30,682. Pivot point for trend change at 30,597. Neutral RSI, which could lead to a sideways movement above the current level, before testing the first resistance level. |

| NATURAL GAS +0.97% |

| One of the world’s leading commodity traders, Russian-based Gunvor, may supply 13 million gallons of gasoline to the United States. In Europe, countries are trying to close long-term supply contracts, following the continuous increase in market demand. Germany has begun implementing the second phase of its emergency gas plan. Meanwhile, Biden’s proposal to Congress to suspend the gas tax received a mixed vote. |

|

| Support 1: 6,205 Support 2: 6.198 Support 3: 6.183 Resistance 1: 6.227 Resistance 2: 6.242 Resistance 3: 6,249 Pivot Point: 6,220 |

| The price is below the 200-day moving average, between support 3 and resistance 1. Expected trading range between USD$6.18 and USD$6.24. Pivot point for trend change at USD$6.22. RSI coming out of the oversold zone, so there may be an important rebound in the market, even more after Freeport’s major force, which is generating a supply shock. |

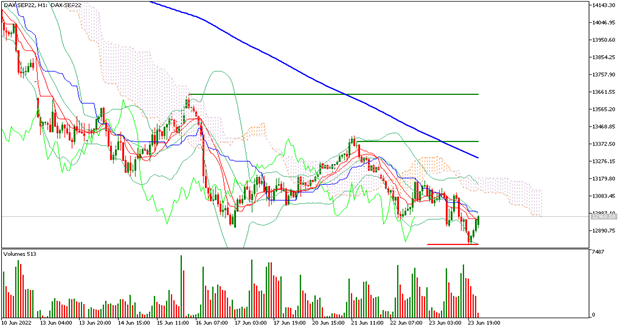

| DAX 40 +0.47% |

| Traders are looking forward to the summit of European leaders. One of the main issues is Ukraine’s accession to the European Union. This may generate even more tension in the energy markets and global geopolitics. At the moment, the DAX 40 is up 0.47% and is trading at 12,969 points. On the other hand, the Euro is correcting due to the tension generated by the stress tests of the banks in the United States due to the recession scenario. |

|

| Support 1: 12894.9 Support 2 : 12883.5 Support 3: 12866.5 Resistance 1: 12923.3 Resistance 2: 12940.3 Resistance 3: 12951.7 Pivot Point: 12911.9 |

| Price is below the 200-day moving average, between support 3 and resistance 1. Expected trading range between 12.866 and 12.951. Pivot point for trend change at 12.911. RSI neutral, so the price could continue rising towards resistance 1. |

| Sources |

| Reuters Market watch Bloomberg Capitalix Market Research |

Divulgation des risques

Toute information/article/matériel/contenu fourni par Capitalix ou affiché sur leur site web est destiné à être utilisé à des fins éducatives uniquement et ne constitue pas un conseil d’investissement ou une consultation sur la façon dont le client devrait faire du trading.

Bien que Capitalix ait veillé à l’exactitude du contenu de ces informations, elle n’est pas responsable de toute omission/erreur/malentendu et ne peut garantir l’exactitude de tout matériel ou de toute information contenue dans ce document.

Par conséquent, toute confiance que vous accordez à ce matériel est strictement à vos propres risques. Veuillez noter que la responsabilité de l’utilisation ou de la fiabilité de ce matériel incombe au client et que Capitalix n’accepte aucune responsabilité pour toute perte ou tout dommage, y compris, sans s’y limiter, toute perte de profit pouvant découler directement ou indirectement de l’utilisation ou de la fiabilité de ces informations.

Avertissement de risque: Le trading de Forex/CFDs implique un risque conséquent pour votre capital. Veuillez lire et vous assurer que vous comprenez parfaitement notre Politique de claude de non-responsabilité.

Vous devez vous assurer que, selon votre pays de résidence, vous êtes autorisé à trader les produits de Capitalix.com. Veuillez vous assurer que vous êtes familier avec la divulgation des risques de l’entreprise.