Daily Review for July 8, 2022

Boris Johnson resigned as Prime Minister of Great Britain.

On Wall Street, stock markets continue to rise. Investors are beginning to have a little more confidence in the Fed to contain inflation.

Traders are looking ahead to the US employment report. Analysts are expecting a Non-Farm Payrolls report of 268,000 new jobs. In May, 390,000 new non-seasonal jobs were created.

Following the week’s uptrend in equities, Bitcoin also rides the rally, this time rising 3.91% and trading at USD$21,162.

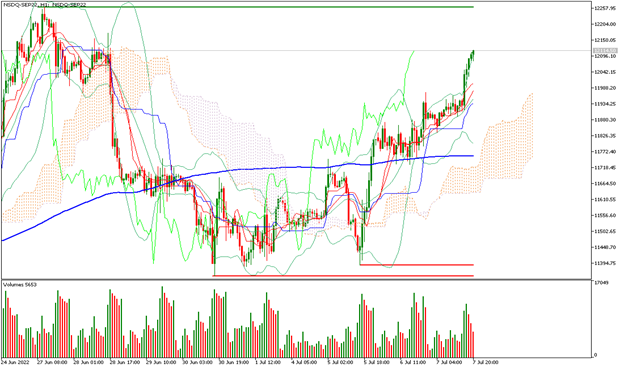

| NASDAQ 100 +2% |

| On Wall Street, stock markets continue to rise. Investors are beginning to have a little more confidence in the FED to contain inflation. At the moment the Nasdaq 100 is up 2% and is trading at 12,095 points. The Nasdaq 100 is up 3.4% this week. Meanwhile, Amazon and Tesla continue to rise. The rebound has not yet been confirmed, but the bullishness in the market is starting to last. Cryptos that have a high correlation with the Nasdaq are also up. |

|

| Support 1: 12053.0 Support 2: 12033.9 Support 3: 12021.6 Resistance 1: 12084.4 Resistance 2: 12096.7 Resistance 3: 12115.8 Pivot Point: 12065.3 |

| The price is above the 200-day moving average, between support 1 and resistance 2. Trading range expected between 12,021 and 12,115. RSI in oversold zone, so traders could start taking profits, and then continue towards the target of 12,300 points in the short term. |

| GOLD +0.14% |

| Traders are watching the U.S. jobs report. Analysts expect Non-Farm Payrolls to report 268,000 new jobs. In May, 390,000 new non-seasonal jobs were created. We will also have a press conference with European Central Bank President Christine Lagarde, who will continue to give indications on the bank’s strategy to curb inflation without affecting economic growth. The US unemployment rate is expected to remain stable at 3.6%. Gold is currently up 0.14% and is trading at USD$1,738 per Troy ounce. Traders have lost interest in the metal, due to the rally in equity markets. |

|

| Support 1: 1737.71 Support 2: 1736.08 Support 3: 1734.01 Resistance 1: 1741.41 Resistance 2: 1743.48 Resistance 3: 1745.11 Pivot Point: 1739.78 |

| The price is below the 200-day moving average, between resistance 1 and support 1. Expected trading range between USD$1,734 and USD$1,745. Pivot point for trend change at USD$1,739. Neutral RSI, so the price could continue sideways until the NFP data, where its trend could be defined. |

| NATURAL GAS +14.41% |

| The U.S. released restrictions on Venezuela’s LPG exports. In Libya there are rumors of civil war, which would generate force majeure to its oil exports. The European Parliament ratified natural gas as a green energy source. Meanwhile, in the USA, the flaring of LNG from the Freeport plant continues. Germany accused Russia of using the commodity as a weapon. However, the fundamental factor that generated the strong rise in the price was the EIA report, which showed a reduction in inventories in the USA. The data for this week showed 2.3 billion cubic feet compared to the 2.6 billion cubic feet usually held in the country. |

|

| Support 1: 6.147 Support 2: 6.055 Support 3: 5.939 Resistance 1: 6.355 Resistance 2: 6.471 Resistance 3: 6.563 Pivot Point: 6.263 |

| Price is above the 200-day moving average, between support 1 and resistance 1. Expected trading range between USD$5.93 and USD$6.56. Pivot point for trend change at USD$6.26. RSI in overbought zone, so traders could take profits, and then have continuity towards USD$7 per BTU. |

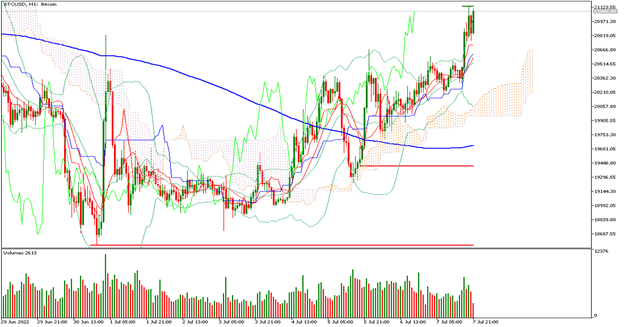

| BITCOIN +3.91% |

| Robinhood is going to allow customers to withdraw Bitcoins to external wallets. After the week’s uptrend in equities, the Bitcoin also rallies, this time rising 3.91% and trading at USD$21,162. Meanwhile, Bloomberg analyst Mike McGlobe, thinks Bitcoin price would have an uptrend in Q3 and Q4 2022, quarters in which the crypto will have more acceptance in real sector usage. The market outlook is for the price to end the year between USD$25,000 and USD$35,000. |

|

| Support 1: 20,780.5 Support 2: 20,676.9 Support 3: 20,526.9 Resistance 1: 21,034.2 Resistance 2: 21,184.3 Resistance 3: 21,287.9 Pivot Point: 20,930.6 |

| The price is above the 200-day moving average, which is a bullish signal for Bitcoin. Expected trading range between USD$20,526 and USD$21,287. Pivot point for trend change at USD$20,930. RSI near the overbought zone, where traders could take profits while holders keep the target at USD$32,000. |

| Sources |

| Reuters Market watch Bloomberg Capitalix Market Research |

Divulgation des risques

Toute information/article/matériel/contenu fourni par Capitalix ou affiché sur leur site web est destiné à être utilisé à des fins éducatives uniquement et ne constitue pas un conseil d’investissement ou une consultation sur la façon dont le client devrait faire du trading.

Bien que Capitalix ait veillé à l’exactitude du contenu de ces informations, elle n’est pas responsable de toute omission/erreur/malentendu et ne peut garantir l’exactitude de tout matériel ou de toute information contenue dans ce document.

Par conséquent, toute confiance que vous accordez à ce matériel est strictement à vos propres risques. Veuillez noter que la responsabilité de l’utilisation ou de la fiabilité de ce matériel incombe au client et que Capitalix n’accepte aucune responsabilité pour toute perte ou tout dommage, y compris, sans s’y limiter, toute perte de profit pouvant découler directement ou indirectement de l’utilisation ou de la fiabilité de ces informations.

Avertissement de risque: Le trading de Forex/CFDs implique un risque conséquent pour votre capital. Veuillez lire et vous assurer que vous comprenez parfaitement notre Politique de claude de non-responsabilité.

Vous devez vous assurer que, selon votre pays de résidence, vous êtes autorisé à trader les produits de Capitalix.com. Veuillez vous assurer que vous êtes familier avec la divulgation des risques de l’entreprise.