Daily Review for July 6, 2022

Fears of a global recession have dragged down the global commodity market. An economic recession would reduce demand for commodities and in turn reduce market supply.

The Euro is down 1.50% against the USD. It is currently trading at 1.0265, the lowest level since 2002.

The impact of the international debt default of one of the main real estate groups in China, Shimao, has generated a massive sell-off in the stock market globally.

Crypto mining company Core Scientific sold 7,000 Bitcoins in June, the equivalent of USD$167 million.

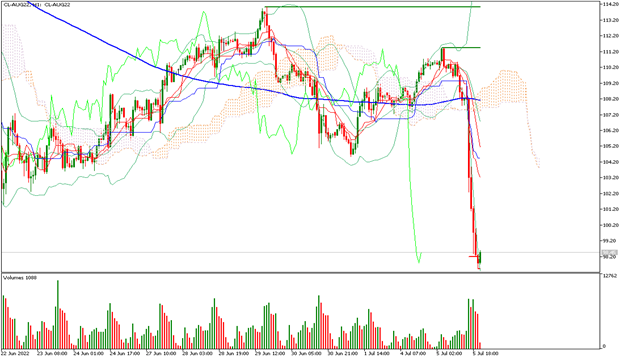

| WTI -9% |

| Fears of a global recession have dragged down the global commodities market. An economic recession would reduce demand for commodities and in turn reduce market supply. Supply disruption has also been generated by Norway’s oil production cut. Citibank anticipates a fall in the price towards USD$65 per barrel. At the moment the price is down 9% and is trading at USD$98.75 per barrel. |

|

| Support 1: 97.32 Support 2: 96.83 Support 3: 96.19 Resistance 1: 98.45 Resistance 2: 99.09 Resistance 3: 99.58 Pivot Point: 97.96 |

| The price is below the 200-day moving average, between resistance 1 and support 2. Expected trading range between USD$96.19 and USD$99.58. RSI in the oversold zone, so traders are evaluating the continuation of the fall towards the next support levels, or on the other hand a buying opportunity. |

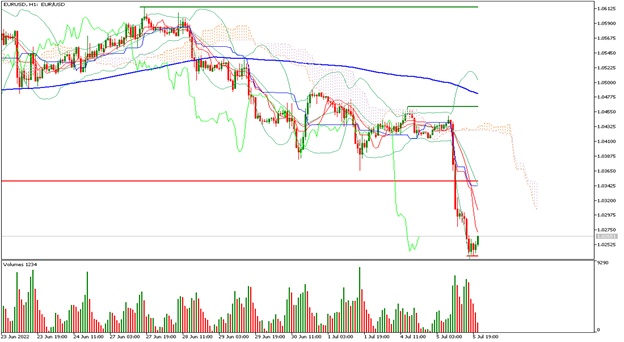

| EURUSD -1.50% |

| The Euro is falling 1.50% against the USD. It is currently trading at 1.0265, the lowest since 2002. The USD is gaining ground against all currencies globally. Euro Bunds are up, rising 1.10% on increased investor interest in an impending global economic recession, which has led to panic in equities. The Euro has been falling sharply since the start of the war in Ukraine. The market is now watching the impact of Russian gas cuts to the European Union. |

|

| Support 1: 1.0242 Support 2: 1.0231 Support 3: 1.0224 Resistance 1: 1.0261 Resistance 2: 1.0269 Resistance 3: 1.0279 Pivot Point: 1.0250 |

| The price is below the 200-day moving average, between resistance 1 and support 3. Expected trading range between 1.0231 and 1.0279. Pivot point for trend change at 1.0250. RSI in oversold zone, which could lead to a rebound from this level. Analysts review a possible scenario of parity with the USD. |

| DAX 40 -2.11% |

| The impact of the international debt default of one of the main real estate groups in China, Shimao, has generated a massive sell-off of shares in the stock market. Similarly, investors’ fear of a global economic recession has led to the liquidation of equities in portfolios. The main fear of investors in Germany is the impact on the economy due to the lack of natural gas and oil supply. Germany reported its first monthly trade deficit in 30 years. |

|

| Support 1: 12481.0 Support 2: 12442.0 Support 3: 12416.0 Resistance 1: 12546.0 Resistance 2: 12572.0 Resistance 3: 12611.0 Pivot Point: 12507.0 |

| The price is below the 200-day moving average, between support 2 and resistance 1. Expected trading range between 12,416 and 12,611. Pivot point for trend change at 12,507. RSI neutral, so the price could continue to fall and the bears attacking the next support levels. |

| BITCOIN +1.80% |

| Crypto mining company Core Scientific sold 7,000 Bitcoins in June, the equivalent of USD$167 million. While declines in the industrial and real sector saw significant drops today, the technology sector, the Nasdaq 100 and Bitcoin rebounded. The Nasdaq 100 rose 1.36%, climbing 157 points. Meanwhile, the Bitcoin is currently up 1.80%, trading at USD$20,195. According to Ark Investment, the Bitcoin has a neutral to positive outlook. |

|

| Support 1: 19,802.4 Support 2: 19,509.7 Support 3: 19,363.4 Resistance 1: 20,241.4 Resistance 2: 20,387.7 Resistance 3: 20,680.4 Pivot Point: 19,948.7 |

| The price is above the 200-day moving average, between resistance 1 and support 1. Expected trading range between USD$19,363 and USD$20,680. Pivot point for trend change at USD$19,948. RSI neutral, so the price could continue to climb positions. The Bulls are looking to overcome the resistance 1, in order to climb towards USD$21,000. |

| Sources |

| Reuters Market watch Bloomberg Capitalix Market Research |

Divulgation des risques

Toute information/article/matériel/contenu fourni par Capitalix ou affiché sur leur site web est destiné à être utilisé à des fins éducatives uniquement et ne constitue pas un conseil d’investissement ou une consultation sur la façon dont le client devrait faire du trading.

Bien que Capitalix ait veillé à l’exactitude du contenu de ces informations, elle n’est pas responsable de toute omission/erreur/malentendu et ne peut garantir l’exactitude de tout matériel ou de toute information contenue dans ce document.

Par conséquent, toute confiance que vous accordez à ce matériel est strictement à vos propres risques. Veuillez noter que la responsabilité de l’utilisation ou de la fiabilité de ce matériel incombe au client et que Capitalix n’accepte aucune responsabilité pour toute perte ou tout dommage, y compris, sans s’y limiter, toute perte de profit pouvant découler directement ou indirectement de l’utilisation ou de la fiabilité de ces informations.

Avertissement de risque: Le trading de Forex/CFDs implique un risque conséquent pour votre capital. Veuillez lire et vous assurer que vous comprenez parfaitement notre Politique de claude de non-responsabilité.

Vous devez vous assurer que, selon votre pays de résidence, vous êtes autorisé à trader les produits de Capitalix.com. Veuillez vous assurer que vous êtes familier avec la divulgation des risques de l’entreprise.