Daily Review for March 07, 2022

The market starts the week in negative territory. An important correction is taking place in all global stock exchanges. The Russian Stock Exchange remains closed.

The US and its allies are thinking of embargoing Russian oil, which caused the price of commodities in the energy segment to rebound. WTI is trading at USD$124.22 per barrel.

Crypto exchanges are under pressure to freeze the assets of Russian customers. As a result, Bitcoin starts the week in negative territory. The European Union and the USA are accelerating the regulatory framework for cryptos.

Traders continue to buy gold. The price of the metal reached USD$2,000 per Troy ounce. There could be additional upward movement, generated by the increase in geo-political tensions.

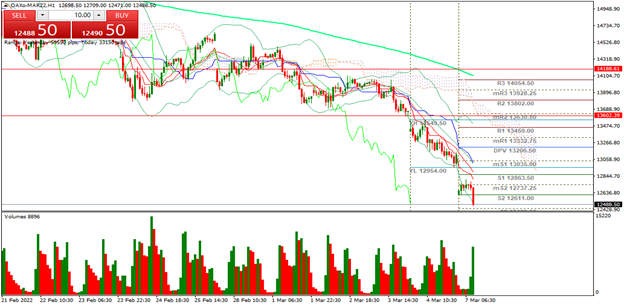

| DAX 40 -4.85% |

| Global stock markets begin the week in negative territory, as a consequence of the continuity of the war in Ukraine and the possible oil embargo to Russia. At this moment, the DAX 40 is down 4.85% and is trading at 12,441, which indicates that it is at the lowest level since January 2022, entering the bear market. European indices are also opening in negative territory with major bearish movements in the IBEX 35, which is down 4.94%. Geo-political tensions will continue to impact equities. Traders continue to watch the commodity rally, US CPI and the ECB meeting on monetary policy measures in the face of the war. |

|

| Support 1: 12,438.0 Support 2: 12,344.5 Support 3: 12,175.0 Resistance 1: 12,701.0 Resistance 2: 12,870.5 Resistance 3: 12,964.0 Pivot Point: 12,607.5 |

| Price is near support 3, entering Bear market. Expected trading range between 12,175 and 12,964. Pivot point for trend change at 12,607. RSI in oversold zone. Bearish channel, which could show a higher volume of sales than expected. |

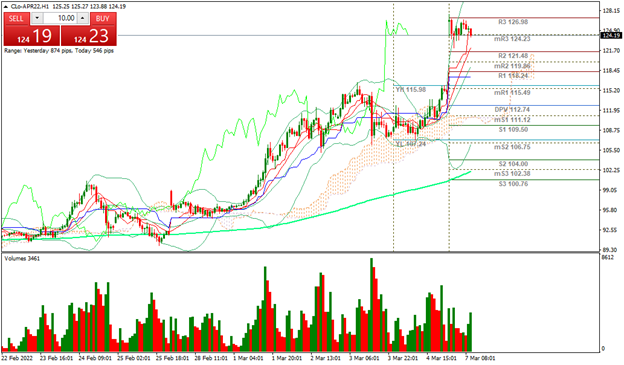

| WTI +6.86% |

| The United States and its allies announced the possible embargo and restriction on Russian oil. Following the announcement, the price of commodities in the energy segment rebounded, with major increases in WTI, Brent and Natural Gas. WTI is currently up 6.86% and is trading at USD$123.41 per barrel. As for the other commodity segments, Nickel is up 26.20% and is trading at USD$37,941. Analysts foresee a continuity in the price increase, due to the decrease in commodities exports from Russia. |

|

| Support 1: 123.22 Support 2: 122.61 Support 3: 121.51 Resistance 1: 124.93 Resistance 2: 126.03 Resistance 3: 126.64 Pivot Point: 124.32 |

| The price is at resistance 3, where traders could start taking profits. In the physical market, traders continue to try to sell and close deals in the spot. Expected trading range between USD$121.51 and USD$126.64. Pivot point for trend change at USD$124.32. RSI in overbought zone. |

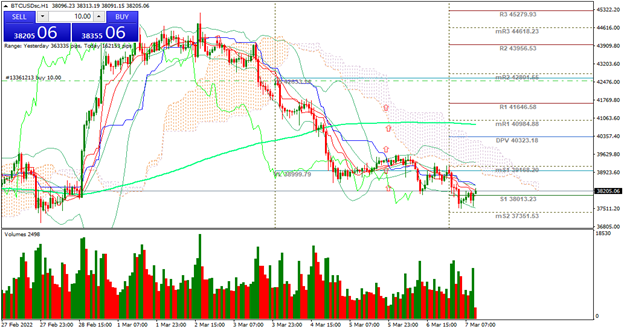

| BITCOIN -2.21% |

| Major crypto exchanges are refusing to freeze the assets of Russian clients. Meanwhile, Bitcoin starts the week in negative territory, currently down 2.21% and trading at USD$38,227. On the other hand, Apple co-founder Steve Wozniak has called Bitcoin as pure gold mathematics. Turning to geo-political tensions, the Ukrainian government is pressuring exchanges to block Russian cryptocurrency transactions. This has also prompted the US and EU governments to accelerate the regulatory framework for cryptocurrencies. |

|

| Support 1: 32,950 Support 2: 29,296 Support 3: 21,865 Resistance 1: 41,335 Resistance 2: 45,850 Resistance 3: 49,203 Pivot Point: 37,798.5 |

| The price is at support 1, where it could generate a change of trend. Expected medium-term trading range between USD$21,865 and USD$49,203. Pivot point for trend change at USD$37,798. Neutral RSI, which supports a possible change of trend. |

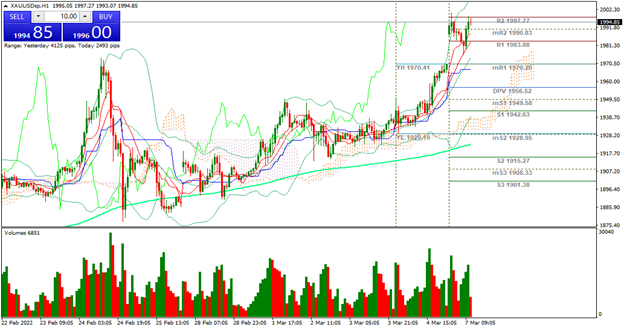

| GOLD +1.72% |

| Investors start the week increasing their exposure to gold due to increased volatility in equities. After starting the market in negative territory, the price of gold reached USD$2,000 per Troy ounce. Gold is currently up 1.72% and is trading at USD$2,002 per Troy ounce. Silver is up 1.40% and is trading at USD$26.15 per Troy ounce. The 3-month, 5-year, 10-year, and 30-year US Treasury bonds are rising, indicating that traders are taking hedge in fixed income and metals. |

|

| Support 1: 1,996.34 Support 2: 1,990.57 Support 3: 1,986.94 Resistance 1: 2,005.74 Resistance 2: 2,009.37 Resistance 3: 2,015.14 Pivot Point: 1,999.97 |

| The price is at resistance 2, where traders’ profit taking could be witnessed. However, under the need to hedge portfolios, the price of gold could witness a further rally towards the USD$2,025 area. Pivot point for trend change at USD$1,999. RSI in overbought zone. |

| Sources |

| Reuters Market watch Bloomberg Capitalix Market Research |

Risk Disclaimer

Any information/articles/materials/content provided by Capitalix or displayed on its website is intended to be used for educational purposes only and does not constitute investment advice or a consultation on how the client should trade.

Although Capitalix has ensured that the content of such information is accurate, it is not responsible for any omission/error/miscalculation and cannot guarantee the accuracy of any material or any information contained herein.

Therefore, any reliance you place on such material is strictly at your own risk. Please note that the responsibility for using or relying on such material rests with the client and Capitalix accepts no liability for any loss or damage, including without limitation, any loss of profit which may arise directly or indirectly from the use of or reliance on such information.

Risk Warning: Forex/CFDs trading involves significant risk to your invested capital. Please read and make sure that you fully understand our Risk Disclosure Policy.

You should ensure that, depending on your country of residence, you are allowed to trade Capitalix.com products. Please ensure that you are familiar with the company’s risk disclosure.