Daily Review for June 02, 2022

After yesterday’s price rally, Italian Prime Minister Mario Draghi proposed the creation of an oil cartel between the US and the European Union to keep prices balanced.

Bitcoin continues to correct for the second day in a row showing that the bear market continues. Bitcoin is currently down 4.57% and is trading at USD$30,040.

European stock markets are in positive territory. Traders are looking forward to the BUBA (German Bundesbank) statement, which may give signals on the European Central Bank’s monetary policy strategy.

Gold prices are up 0.30% and are trading at USD$1,853 per Troy ounce. Traders are holding long positions in their portfolios, waiting for a high volatility derived from the US Non-Farm Payrolls data.

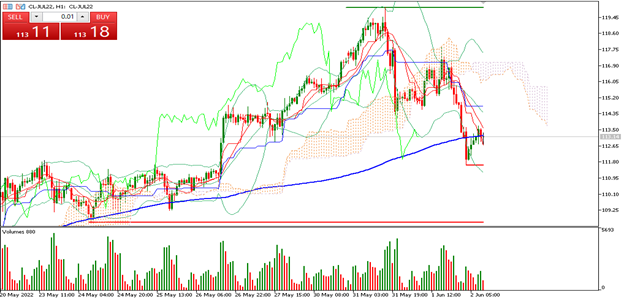

| WTI -1.93% |

| After yesterday’s price rally, Italian Prime Minister Mario Draghi proposed the creation of an oil cartel between the US and the European Union to keep prices balanced. At the moment, the price of crude oil is down 1.93% and is trading at USD$113.08 per barrel. On the other hand, OPEC+ stated that it does not intend to suspend Russia from the cartel’s production. The Russian and Saudi Arabian delegates also stated that OPEC+ remains strong despite the European Union’s energy sanctions on Russia. |

|

| Support 1: 112.85 Support 2: 112.54 Support 3: 112.16 Resistance 1: 113.54 Resistance 2: 113.92 Resistance 3: 114.23 Pivot Point: 113.23 |

| The price is at the same level of the 200-day moving average. Expected trading range between USD$112.16 and USD$114.23. Pivot Point for trend change at USD$113.23. RSI neutral, so the price correction could continue towards the support 1 line at USD$111 per barrel. |

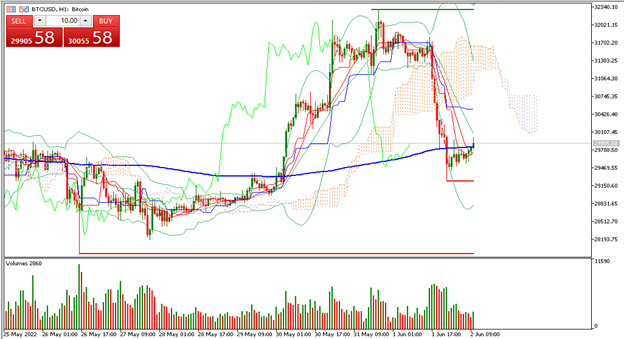

| BITCOIN -4.57% |

| Bitcoin continues to correct for the second consecutive day showing that the bear market continues. Bitcoin is currently down 4.57% and is trading at USD$30,040. Traders continue to evaluate the market. The Bears continue to gain ground. The objective of the Bears is to take the price to the level of USD$10,000. However, the institutions maintain the volume of purchases above the current level, so the price is moving sideways. |

|

| Support 1: 29,883.6 Support 2: 29,809.8 Support 3: 29,762.6 Resistance 1: 30,004.6 Resistance 2: 30,051.8 Resistance 3: 30,125.6 Pivot Point: 29,930.8 |

| The price is slightly above the 200-day moving average, between resistance 2 and support 1. Expected trading range between USD$29,762 and USD$30,125. Pivot point for trend change at USD$29,930. RSI coming out of the oversold zone, so the price could change trend at the current moment. |

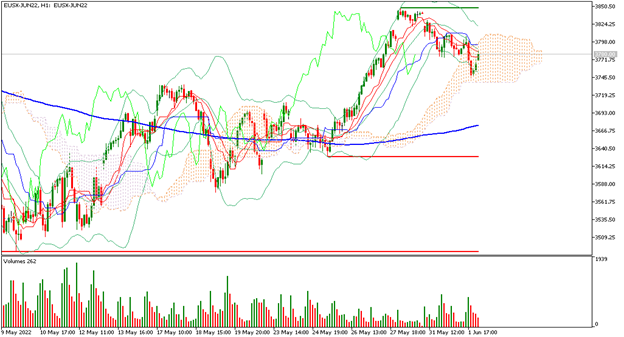

| EUROSTOXX 50 +0.61% |

| European stock markets are in positive territory. Traders are watching the statements of the BUBA (German Bundesbank), which may give signals on the monetary policy strategy of the European Central Bank. Analysts are holding out the prospect of a rate hike for the July 2022 meeting. Traders are also watching the US Non-Farm Payrolls report, which may give a clear picture of the US economy’s performance. At the moment the Eurostoxx 50 is up 0.61% and is trading at 3,780. |

|

| Support 1: 3,764 Support 2: 3,757 Support 3: 3,754 Resistance 1: 3,774 Resistance 2: 3,777 Resistance 3: 3,784 Pivot Point: 3,767 |

| Price is above the 200-day moving average between resistance 2 and support 1. Expected trading range between 3,757 and 3,784. Pivot point for trend change at 3,767. RSI neutral, so buying volume and the uptrend could continue towards the next resistance levels. |

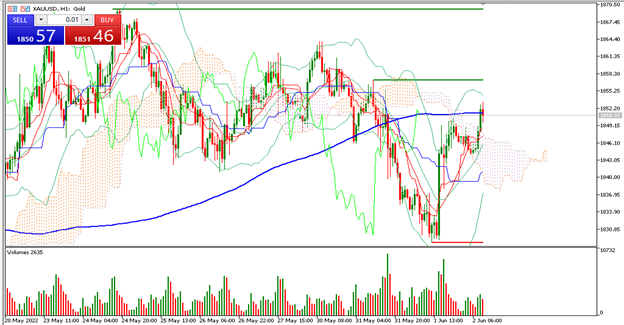

| GOLD +0.30% |

| The price of gold is up 0.30% and is trading at USD$1,853 per Troy ounce. Traders are holding long positions in the portfolios, waiting for a high volatility derived from the US Non-Farm Payrolls data, which is a thermometer of the economy’s performance. Likewise, traders maintain buying positions in silver. As for Bitcoin and Ethereum, traders hold some positions, waiting for the results of the Ethereum update. |

|

| Support 1: 1,851.86 Support 2: 1,848.93 Support 3: 1,847.01 Resistance 1: 1,856.71 Resistance 2: 1,858.63 Resistance 3: 1,861.56 Pivot Point: 1,853.78 |

| The price is at the same level of the 200-day moving average, between resistance 1 and support 2. Trading range expected between USD$1,847 and USD$1,861. RSI neutral, so the buying volume could continue which would push the price towards USD$1,870 per Troy ounce. |

| Sources |

| Reuters Market watch Bloomberg Capitalix Market Research |

Risk Disclaimer

Any information/articles/materials/content provided by Capitalix or displayed on its website is intended to be used for educational purposes only and does not constitute investment advice or a consultation on how the client should trade.

Although Capitalix has ensured that the content of such information is accurate, it is not responsible for any omission/error/miscalculation and cannot guarantee the accuracy of any material or any information contained herein.

Therefore, any reliance you place on such material is strictly at your own risk. Please note that the responsibility for using or relying on such material rests with the client and Capitalix accepts no liability for any loss or damage, including without limitation, any loss of profit which may arise directly or indirectly from the use of or reliance on such information.

Risk Warning: Forex/CFDs trading involves significant risk to your invested capital. Please read and make sure that you fully understand our Risk Disclosure Policy.

You should ensure that, depending on your country of residence, you are allowed to trade Capitalix.com products. Please ensure that you are familiar with the company’s risk disclosure.