Daily Review for August 02, 2021

The market starts the week with bullish movements, mainly in Asian and US stock indexes.

The market is aware to the NFP data. The Delta variant could delay Biden’s infrastructure plan and the economic recovery.

German retail sales rose 4.2% in July 2021. Domestic demand is recovering. The market is now focused on the manufacturing PMI.

Bitcoin corrects, but manages to stay near USD$40,000. The market is aware of the Ethreum platform update.

Price of gold corrects, but could present a change in trend soon, as the Delta variant forces countries to close borders, with which, the economic recovery of the sectors could begin to slow down.

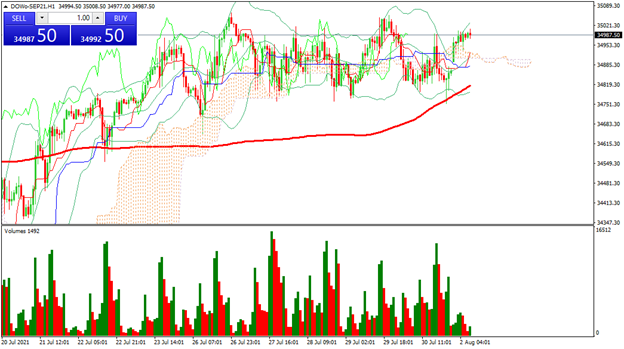

| DOW JONES +0.46% |

| The index starts the week up 0.46%, trading at 35,096 points. The increase of cases of the Delta variant could pressure the equities market in the coming weeks. The number of cases from Europe is increasing. With the US closing its air borders, economic sectors such as tourism and airlines are likely to start feeling cash pressure. Today, traders are looking forward to the US manufacturing PMI. |

|

| Support 1: 35,088.5 Support 2: 35,075.9 Support 3: 35,065.0 Resistance 1: 35,112.0 Resistance 2: 35,122.9 Resistance 3: 35,135.5 Pivot Point: 35,099.4 |

| The index is above the 200-day moving average. It is near the double top formed at 35,058. If the Bulls manage to overcome this resistance, the price could continue towards 35.150. On the other hand, it could correct towards 34.819. Pivot point at 35.099. |

| DAX 30 +0.43% |

| Retail sales in Germany exceeded market expectations, rising 4.2% over 2% expected. This is a sign that the German domestic market is in recovery phase, with demand driving the economic engine. Traders are now waiting the manufacturing PMI for Germany and also for other European Union members. If the data is confirmed to be above expectations, the index could maintain its upward trend. |

|

| Support 1: 15,624.6 Support 2: 15,618.8 Support 3: 15,613.6 Resistance 1: 15,635.6 Resistance 2: 15,640.8 Resistance 3: 15,646.6 Pivot Point: 15,629.8 |

| Sideway channel between 15,451 and 15,638. Expected trading range between 15,613 and 15,646. Pivot point at 15,629. RSI neutral. The price is at a double top. If the macro economic data is good enough, the price could overcome the current resistance and climb towards 15,700. |

| BITCOIN -4.81% |

| The cryptocurrency starts the week correcting 4.81% as a result of the Bulls’ profit taking, which started closing positions at the level of 42,514. Bitcoin is currently trading at USD$39,630. Since last week, the crypto market started the recovery phase. The developers of Ethereum, announced the prompt update of the platform. El Salvador continues with the adoption of Bitcoin. German Institutional Funds have started to buy cryptos. In other words, the risk appetite for cryptos is once again generating upward movements in the market. |

|

| Support 1: 39,621.1 Support 2: 39,512.2 Support 3: 39,413.8 Resistance 1: 39,828.3 Resistance 2: 39,926.6 Resistance 3: 40,035.5 Pivot Point: 39,719.4 |

| The price is still above the 200-day moving average. Bitcoin is close to the Pivot Point, which could generate a change of trend. Possible movement above 39,710 with escalations towards 41,194. RSI in oversold zone. |

| GOLD -0.31% |

| The price of gold has fallen back towards the support of USD$1,807 per Troy ounce. On Friday we will have the NFP data in the United States, where the market expects at least 900,000 new jobs. The U.S. employment projection is based on Biden’s infrastructure plan and economic recovery. The main obstacle to the above is the Delta variant. Closing of air borders and the spread of the variant would delay Biden’s execution and the economic recovery. As a result of the above, gold could be marking a good buying level. |

|

| Support 1: 1,812.11 Support 2: 1,809.93 Support 3: 1,807.86 Resistance 1: 1,816.36 Resistance 2: 1,818.43 Resistance 3: 1,820.61 Pivot Point: 1,814.18 |

| Price is at the same level of the 200-day moving average. Expected trading range between 1,807 and 1,820. Pivot point at 1,814. RSI in oversold zone. Possible bounce towards 1,820. |

| Sources |

| Reuters Market watch Bloomberg Capitalix Market Research |

Risk Disclaimer

Any information/articles/materials/content provided by Capitalix or displayed on its website is intended to be used for educational purposes only and does not constitute investment advice or a consultation on how the client should trade.

Although Capitalix has ensured that the content of such information is accurate, it is not responsible for any omission/error/miscalculation and cannot guarantee the accuracy of any material or any information contained herein.

Therefore, any reliance you place on such material is strictly at your own risk. Please note that the responsibility for using or relying on such material rests with the client and Capitalix accepts no liability for any loss or damage, including without limitation, any loss of profit which may arise directly or indirectly from the use of or reliance on such information.

Risk Warning: Forex/CFDs trading involves significant risk to your invested capital. Please read and make sure that you fully understand our Risk Disclosure Policy.

You should ensure that, depending on your country of residence, you are allowed to trade Capitalix.com products. Please ensure that you are familiar with the company’s risk disclosure.